What is an NFT?

NFT is a way of attaching ownership to digital objects. Everything digital therefore becomes a kind of irreplaceable digital artwork. This leads to interesting, amazing developments. Why would anyone pay $69 million for a ‘digital picture’?

About the author: Jarno Duursma is a technology expert, author and speaker in the field of digital technology. Creator of the Listening to the future tech podcast, he is often seen and heard in the national media.

How the NFT hype arose

The NFT hype has been around for much longer, but on March 11, 2021, things became totally crazy. Artist Beeple sold his digital collectible Everydays: the First 5000 Days through auction house Christie’s for the enviable sum of $69 million. An NFT artwork that the artist worked on for over 13 years. It is the first NFT work to be sold by a traditional auction house. A week later, Twitter founder Jack Dorsey’s very first tweet was sold as an NFT for over $2.9 million. (See my comment on the national 8 pm TV news program.) In April 2021, a concert by DJ Don Diablo was sold for €1.2 million. (I spoke about this in a news programme for young people). And in May 2021, memes like Disaster girl ($495K) and Bad Luck Brian ($36K) were sold as NFTs.

It is great to see that concepts that were written and thought about years ago are now becoming reality. The very first Dutch-language book on the Bitcoin blockchain (which was written by me) was published in 2016. Digital ownership, digital scarcity, and crypto-collectibles in particular were still mostly theoretical concepts back then. They have since been put into practice.

CryptoKitties

In 2017, CryptoKitties was one of the first NFT projects to receive a great deal of attention. It is a game built on the Ethereum blockchain that allows players to collect, breed and exchange virtual cats. They were the ‘Pokémon cards of the Bitcoin era’, according to Wired Magazine. And it was a huge success. I was surprised to learn that the game had overloaded the Ethereum blockchain due to mass interest and subscription.

In 2018, companies were raising investments through cryptocurrencies, using ICOs – which stands for Initial Coin Offerings. Almost all of these projects were called off or ultimately turned out to be a scam, leaving investors with worthless tokens. Will this be the case again with NFT?

What is an NFT?

An NFT is a Non-Fungible Token: a non-exchangeable, irreplaceable certificate of ownership. You can create this certificate digitally and attach it to a digital object such as an image, and link it to a blockchain. This allows you to prove that the digital object is your property. By creating this certificate, you will create ownership. You keep the certificate in a digital wallet. An NFT is your own unique proof of authenticity.

Using NFT technology, someone can suddenly ‘appropriate’ a tweet, or an image, or a video. And where there is possession, there will also be scarcity due to the economic law of supply and demand. Technically, creating scarcity in the digital domain has always been a huge challenge. After all, in the digital world you can copy, multiply and share things with the greatest of ease. However, this is being changed radically by NFT technology, with a new value system being created in the process.

You can create an NFT from anything digital, such as song recordings, photos, movies, Twitter messages, articles, TikTok videos, computer game purchases, professional videos and soundtracks. NFTs are nowadays mostly used as collectibles and digital art. There are several NFT marketplaces, such as OpenSea, Rarible and Nifty Gateway.

Cryptocurrency and crypto art

NFT is often associated with cryptocurrency, but it does not have much to do with the features of a Bitcoin, for example. On the contrary, a Bitcoin is interchangeable and replaceable. Currencies require a free exchange between coins, digital or not. In short, whether I have Bitcoin number 856354 or Bitcoin 976453 in my possession, this will not change its value. This is different in the case of an NFT. An NFT could be an expensive digital basketball video, a video of the burning of a Banksy painting, a relatively worthless digital drawing, or the world’s first Twitter post. NFTs are therefore different. You cannot exchange a CryptoPunk picture for a CryptoKitties picture.

Buying an NFT

If you want to sell an image on a virtual NFT marketplace, all kinds of activities will be happening in the background. Suppose I want to sell a digital artwork.

First of all, I create an account on a marketplace, for example Mintable. I upload my image. I also add metadata to the image on the website. These are data that describe, for example, what the image looks like, how the image was created, where the image is located and what the accompanying story is about. You can actually regard the metadata of an NFT token as the sign that hangs next to a painting in a museum.

This ‘portfolio’ of data is subsequently packed together in a so-called ‘hash’. Hashing the data means that you use a mathematical formula to cryptographically transform the folder into an encrypted version, i.e. a series of unique numbers and letters. Then you attach your own digital signature based on your chosen password.

This data is combined and then stored on all computers connected to a blockchain network, for example Ethereum or Flow. Such a blockchain works like a shared ledger, a permanent public record that anyone can access, but no one can change anything. So you can readily see in a blockchain database which people own or owned an NFT token; all historical ownership data is in the database. After posting, the NFT is ‘minted’ and is part of the blockchain database.

By the way, in order to be able to place the NFT on a blockchain, you pay a small network fee, called GAS. You pay this from your digital wallet. You can store your NFTs in the same wallet.

Technically, an NFT is an assignment of economic ownership of a particular product to a particular account in the blockchain ledger. These technical steps give the image a certificate of authenticity, which then cannot be changed or deleted. There are several standards for creating and issuing NFTs. The most widely used is ERC-721, a standard, a blueprint, on the Ethereum blockchain. Parties like Eos, Tron and NEO have also released their own NFT token standards.

“NFTs Will Make You an Artist The Same Way Instagram Made You an Influencer.”

-GaryVee

Examples of NFT

The most compelling NFT example is the case of Beeple’s $69 million NFT artwork, which I mentioned at the beginning of this article. As a result, artists around the world are beginning to understand that it is possible to use NFT technology to sell artworks to an audience willing to pay for them.

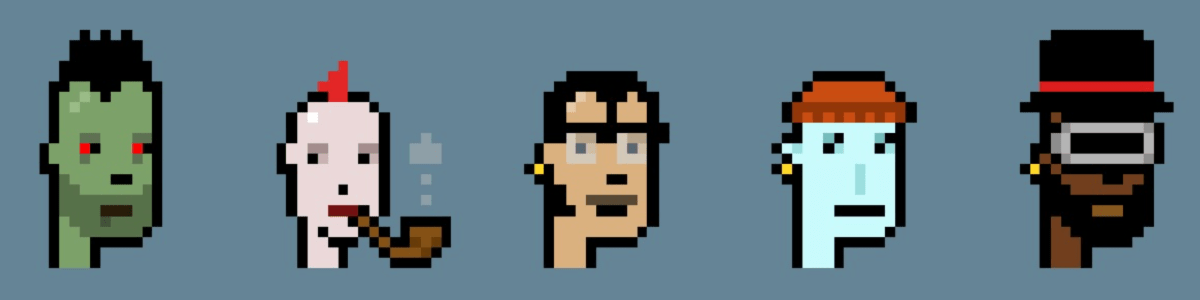

Furthermore, there are other well-known NFT objects like the CryptoPunks images. Of these, only 10,000 unique CryptoPunks NFT images were created. Each one was generated algorithmically through computer code, which means that none of them looks like another. At this point, the price of some Cryptopunks could amount to tens of thousands of dollars.

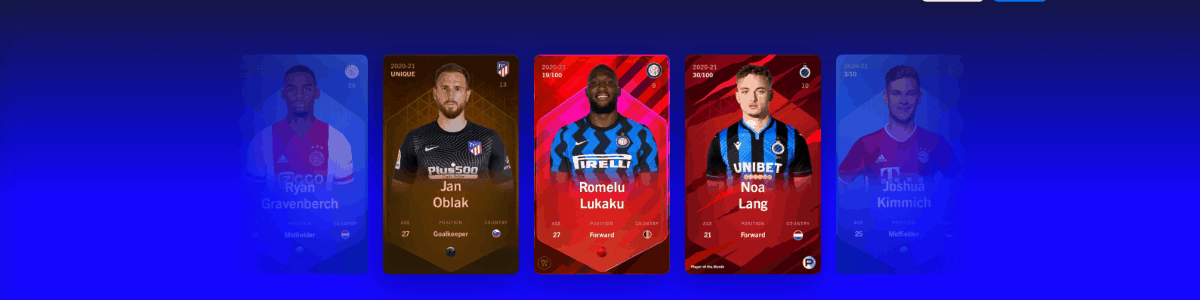

Buy a piece of video

At NBA Topshot, you can now become the owner of an NFT of a unique piece of video footage of highlights from NBA games. In this way, you buy a specific and unique piece of a video about basketball history. For example, an NBA Top Shot video of basketball player Ja Morant is currently for sale at $240,000.

Furthermore, there are several virtual reality worlds such as CryptoVoxels, Axie Infinity and Decentraland. NFTs in the latter game represent parcels of land in different districts of the virtual world. Players can sell, exploit or exchange these pieces of land.

“NFTs are a Digital Renaissance”

– Coindesk

Value and NFT

People have always placed emotional and aesthetic value on physical goods, such as paintings, cars and watches. They are willing to pay a lot of money for these items. Until now, however, digital objects did not have the same value, as they were never unique. Indeed, they could easily be duplicated, copied or reproduced so that they became everyone’s (and therefore no one’s) property.

At this point, NFTs create the possibility of attaching ownership to digital objects. It is the possibility of transferring ownership from one person to another, thereby creating value. This could be a game changer: until recently, there was no instrument against the infinite multiplication of digital objects at negligible cost. (Read about the challenges NFT technology faces).

Valuation of NFT

When discussing NFT, you will quickly arrive at the follow-up question: What is value? What is the value of a pick you caught at a Harry Styles concert? What is the value of a soccer record? What is the value of a Flippo? What is the value of the famous Charlie bit my finger video? The value of an object is rarely determined by the object itself. It is what people who find it valuable attribute to it and are willing to pay for it. A Picasso painting is virtually worthless if you only look at the composing materials of wood, paint and canvas. On the other hand, the price the object receives from a shared cultural belief is tremendously high.

I would pay a lot of money to be the NFT owner of the only video recording of the first plane to crash into the WTC in New York on September 11, 2001. Its historical value is tremendous, and so is its financial value. Important tweets, videos, GIFs and audio recordings become the new digital real estate with NFT technology. Just as domain names on the Internet and social media usernames already are.

NFT Collector Value

So this is what makes NFT development so wildly interesting. Everything on the Internet can now become art or something with collector’s value. Something that previously seemed worthless, because it was infinitely reproducible, can now gain value through the combination of NFT technology, marketplace technology, cultural belief and fandom. This last aspect is then mainly about a group of fans with a strong subculture among them.

Suppose you are a designer, and a few years ago you came up with a funny cartoon character called Nyancat. Then this funny character is picked up and viewed and shared hundreds of millions of times on the Internet. What happened? You accidentally created a meme. It may be fun to show your friends and talk about on a birthday party, and financial value is not at issue. However, this has suddenly changed. The Nyancat meme was recently sold at an NFT auction for $600,000. So memes turn out to be creations with value, just like works of art.

Are you a person who unintentionally created a viral video on TikTok once? This, too, may now represent financial value. Are you a famous artist who still has a demo version of a song on the shelf? Did you, as an independent pop journalist, interview singer Adele once, when she was relatively unknown? With NFT, this creates value.

Buyers of NFT products

People who buy NFT have two different motives: feeling and reason. Feeling is mainly seen in people who experience emotion or passion with a particular soccer club, artist, musician, celebrity, online culture or community. They want to be a small part of the bigger picture of which they are a fan.

Their reality is colored in part by a strong mutual subculture. They want to support this subculture. This group will also buy an NFT product because they want to financially support the artist or the creator, for example. They want to make it possible for this person to continue doing their work.

Incidentally, we should not underestimate that a proportion of NFT buyers purchase an NFT work for obtaining ‘bragging rights’: the opportunity to brag about the NFT property to family, friends, peer groups and social media followers and gain their admiration. A second audience group will buy primarily for rational reasons: to make money from it. They see it as a form of investment or speculation, expecting that what they buy will increase in value in the future.

The value of an NFT object

In this respect, the value of NFT is similar to the traditional art and auction business. In the art world, you buy or sell a piece of art history or aesthetic beauty in the form of an object, and now the same is happening on the Internet. With the purchase of the Beeple painting, the creator simultaneously became the owner of a beautiful creation as well as a piece of valuable Internet history.

The value of an object can also be high as a result of the origin, genesis and chronology of that particular object. And, of course, it matters a lot if the object is actually scarce. Is it a single, unique copy? Or were 50 numbered copies made, as we know from a screen print? NFT technology makes this possible as well. Of course, financial value also depends on the reputation and popularity of the creator, as an artist, celebrity or online community.

“NFTs create a new value system for the Internet.”

– Dimitri de Jonghe

Countervalue of NFT

What do you actually get when you buy an NFT, for example from an image? This is a good question. The simplest answer in technical terms is that you have a claim in the blockchain database stating that you are the economic owner of that particular NFT product.

Legally, by the way, you are not automatically the owner of the image: it is not a certificate of full ownership. Unless you explicitly arrange it, for example, the copyright stays with the creator of the image. Just as you are not the owner of a song when you buy a CD, you will not automatically become the owner of the image. Therefore, you may not reproduce the image and offer it for sale on your website. The rights still remain with the artist. You may reproduce the image ‘for personal study, exercise or use’, according to article 16b-c of the Dutch Copyright Act.

NFT Screenshots

By buying the image, you implicitly receive permission from the creator to resell the NFT. Although it is not allowed, for example, to take twenty screenshots of your proof of ownership and offer these screenshots for sale as NFTs.

Technically, it is possible to extend the sale or right of disposition to include actual ownership, royalties, intellectual property or other items of value. However, all these things have to be included and explicitly programmed into the smart contract. A smart contract is a computer program that controls the rules you agree on and then executes them autonomously and decentrally. An example includes the rules for automatically paying back in installments.

Another footnote: It is an interesting fact that a digital certificate of authenticity may be valuable, while the infinitely reproducible artwork itself is not. It raises questions about what ’art’, ’value’, ‘ownership’ and ‘authenticity’ actually mean in the digital world.

Smart contracts

Smart contracts enable you to arrange other things as well, such as agreements about royalties and intellectual property. Smart contracts also make it technically possible to transfer a certain percentage of the sales price when the object changes owner again. It can be technically programmed that every new buyer pays 10% of the proceeds to the original creator. So, in 2021, an artist may look in his or her inbox in the morning and see that he or she has earned a few thousand euros from the secondary sale of his work.

Additional NFT technology also makes it possible for, let’s say, 100 people to simultaneously buy a different piece of an NFT product: so-called fractional ownership. Something like this happened when a Cyberpunk NFT image was purchased, for example. The expenses are shared because a single image is just too expensive for a single person to buy independently. Together with others, it will be possible.

Artist Sara Ludy, for example, set up a smart contract in this way. When she sold her digital art, 35% of the proceeds would go to a gallery called Bitforms and the money was to be shared equally among the four collaborators.

Popularity of NFT

The NFT development has become popular in 2021. The question could be raised: why not earlier? Surely it has been around for much longer. There are several factors to consider.

Familiarity with the crypto world

Unlike four years ago, very few people knew about cryptocurrencies. This has since changed dramatically. Almost everyone is familiar with Bitcoin, Ethereum, digital wallets and crypto exchanges. The ease of use has also increased significantly.

FOMO: Fear of Missing out

Needless to say, FOMO plays an important role in the newfound popularity. People realize something is going on: there is a buzz. A new piece of Internet history is being created as we speak. You can read it in the papers, it is on television, and it is visible on social media. This creates a fear of missing the boat and going empty-handed. Those who acted in time with, for example, Bitcoin, are winners now. Those who were too late missed out.

Spending cryptocurrency

Many cryptocurrency enthusiasts have become wealthy in recent months due to the explosive rise of crypto currencies. Some of them want to spend this ‘new money’ on a new phenomenon in their own crypto world: NFTs. Some out of affinity with this online culture, others hope to repeat the crypto trick.

Making money in times of COVID

Since the pandemic, we have been online more often and many Internet surfers and newcomers are discovering new and interesting ways of making money. NFT can be seen as a combination of online gambling and day trading. Interest rates at traditional banks are low, so NFT speculation is a good alternative.

‘There is no doubt that NFT will play a pivotal role in bringing the digital and physical worlds closer to one another than they have ever been before.’

– nonfungible.com

Future use cases

The development of NFT technology is only just beginning. However, it is a trend that will continue to expand. What is about to happen anyway is that celebrities, artists, musicians, companies are going to convert the value of their creations to NFTs. And so will others who play an important role in the world of art, culture, sports, advertising or showbiz.

Coca-cola

Coca-cola, for example, might start creating a unique digital series of modernly designed bottles. You might be able to buy these objects in an NFT marketplace, win them in a lottery or earn them through an online game.

H&M

In the future, H&M could sell you not only a pair of red pants that you wear in the real world, but also a digital copy of the same red pants that you could then wear online at night when playing Fortnite. Provided you have reached a certain level of skill in this game, for example.

Shawn Mendes

Have you been to a Shawn Mendes concert? An NFT link will turn your admission ticket into a collector’s item.

Topshot

The basketball cards you bought as an NFT in Topshot can be used in a virtual game at a later time, just as Pokémon cards can now be used in a physical game. Playing with these cards will enable you to increase their value.

Bands

Bands release NFTs for ‘special releases’ of their albums, or for live show backstage passes, front-row seats, golden tickets for a meet-and-greet, or they may issue NFTs for exclusive audio-visual art. Or a few seconds of ‘airtime’ in a future documentary could be sold to fans as NFTs.

Football players

A famous football player could make five NFTs of five sessions in which he gives a soccer clinic to a small groups of fans. Or, alternatively, he may decide that there will only be one session per season, so as to make it more exclusive.

YouTubers

YouTubers could create an NFT from parts of their daily vlog. For fans, it is nice to own this, but you could also include in the smart contract that the person in question gets 10% of the advertising profits from the video. In this case, the fan becomes a kind of shareholder in this video. The financial value that this NFT share represents could be an excellent collateral for a loan in dollars or euros, in the real world.

Influencers

Well-known influencers could create an NFT from a video they record together and automatically donate the proceeds to a charity foundation.

Another possible scenario is one in which today’s NFT marketplaces become the YouTube and Spotify of the future. Where you can listen and watch content and thus buy NFTs at the same time.

Challenges of NFT

Because this technological NFT landscape is still young and fledgling, there are issues that still need to be resolved.

Verification

The very first issue concerns verification of ownership. How can you be sure that an image or video really belongs to the person offering it on an NFT marketplace? After all, it is not difficult now to steal an image from an artist and offer it on a marketplace. The chances of discovery are very low, especially when the artist is lesser known. So marketplaces face the challenge of preventing fraud and theft. At marketplace Super Rare, for example, artists must first apply to be accepted into its official network before they can start selling on the platform.

Money laundering

NFTs are also suitable for money laundering. Suppose someone has a load of cash to launder. They could create an NFT and buy it back for the same amount with an anonymous wallet, and this could justify the obtained amount.

Dependency

Companies and creatives should also consider to what extent they want to become dependent on existing NFT marketplaces in the future, both in selling their products and in building their fan base. A phenomenon like this can be observed in online department stores such as Bol.com or Amazon.com.

Marketplaces offer traffic to a digital product because they make use of the ‘network effect’. And this traffic, this interest, is of course what is desired to the extent where, ultimately, as many people as possible will bid on your product. NFT marketplaces also offer ease of use for buyers and sellers. Difficult technical intermediate steps are simplified. Marketplaces can operate in the middle.

Hackers, corruption, scams

Another problem that remains to be tackled is keeping the entire NFT chain and infrastructure clean and watertight. In a scenario in which the amounts that are paid for NFTs increase, the relevant companies will become more susceptible to hackers, internal individual corruption, intentional scams, technical failures and human error. If a founder of an NFT company decides to leave for the beach in a shady far-away place with a bag full of Ethereum coins, its customers may have lost everything. Another scenario might be one in which the digital artist has stored data incorrectly on their website and has defaulted in payment for their domain registration. Or they may have unthinkingly updated their website, where the URL with your image has accidently disappeared. In these cases, you may have lost everything too.

By the way, we know these questions and risks from the regular crypto market. Sometimes these fears are justified, sometimes they are not.

Old-timers will remember how The DAO was hacked due to vulnerabilities in its code and how the network was eventually split into two blockchains: Ethereum and Ethereum Classic. In 2017, the company Parity lost over 150,000 ETH (roughly $30 million at the time) to a hacker who exploited a vulnerability in its software wallet.

On the other hand, Coinbase is currently the largest cryptocurrency online exchange in the United States. Many have parked their Bitcoin there. So, in this case, too, they technically do not own their Bitcoin. Again, the same applies as with NFT: “If it’s not your wallet, then it’s not your coins.” And yet, despite this risk, Coinbase is super great. The company is gaining customer confidence. No one expects the company to suddenly shut down, with the creators having themselves spirited away. Ultimately, it is likely that a number of trusted NFT marketplaces will take control of the NFT domain.

Until then, be careful what you buy, look at who offers it for sale, and ask yourself whether this person is the owner, consider the stability of the marketplace where you buy it and check the maintenance standards of the site where the image, video or MP3 is hosted.

In the long run, by the way, you will probably be able to independently own and trade your NFT collection (i.e. both the token and the actual image or video) on decentralized marketplaces.

Artificial wealth

Another problem is that the demand for NFTs may be artificially inflated by, for example, befriended funders who create publicity. This publicity, in turn, may boost the market price because potential buyers erroneously believe that there is apparently a great deal of demand and that the NFT is valuable. Digitally, this form of fraud is easier to organize than in the traditional, physical world.

No sanctions or authority

Finally, there is the major problem that you cannot currently enforce sanctions when an artist is negligent or criminal, nor will you be able to do so in other legal disputes. There is no regulation in place, nor are there any laws or jurisdiction. There is no authority you can go to if you do not receive royalties you are entitled to.

Conclusion on NFT

NFT technology could be viewed from a distance as a revival of the digital arts, but it is more than that. NFT technology is a way of linking ownership to digital objects. Anything you can digitize thus becomes a kind of irreplaceable digital artwork.

Enthusiasts will point out that this technology makes it possible to bring ownership to the Internet, thereby creating ‘a new value system for the Internet’. This is a very interesting observation that entails quite a few consequences. Everything on the Internet may be regarded as an irreplaceable digital artwork. However, the entire NFT ecosystem still needs to mature and there are plenty of challenges.

We are only at the beginning of the explosion of NFT possibilities. However, it is certain that celebrities, artists, musicians and companies will convert the value of their products, services, creations and (online) popularity into NFTs, thereby creating financial value.

Although there are still problems to be tackled and the starting problems have certainly not disappeared, a whole new market will emerge in which the entire system of creatives, companies, speculators, fans and associated online subcultures will reap the sweet fruits of digital NFT products and associated profits.

Another tip: do not buy NFTs with money you cannot afford to lose and use your common sense. Mind you: when it seems too good to be true, it probably is. Out there are a lot of unstable companies and clever scammers operating in the NFT market.

Do you have comments, additions, ideas? Please get in touch!

Best regards, Jarno

Acknowledgements

Thanks very much for reading along and contributing ideas: Roel Boer (Litebit), Rutger van Zuidam (Odyssey.org), Dimitri De Jonghe (Keyko), Gert Gritter, Jetse Sprey (Versteeg Wigman Sprey Lawyers)